DIGITAL

WALLET SOLUTION

Empowering seamless, secure, and cashless transactions for the digital age.

Let’s Discuss Your Goals

5M+ Active Users

OUR ALL-IN-ONE FINANCIAL COMPANION

PRODUCT OVERVIEW

The platform is a modular digital banking solution that enables financial institutions to launch fully branded mobile wallets, customized to different user segments and regulatory tiers.

Key capabilities include:

The mobile application is designed for intuitive shopping and high engagement:

- Multiple account types (Gen-Z, Freelancer, Level 0, Level 1, Ultra)

- Multilingual user interface

- Utility, government, and lifestyle payments

- Integrated savings, investments, and micro-insurance

- Merchant accounts with QR-based payment acceptance

- User engagement tools like Invite & Earn, Spin & Win, and loyalty programs

Whether addressing microfinance clients, freelancers, or high-net-worth individuals, the platform serves as a comprehensive financial interface tailored for all segments from low-limit, entry-level users to premium, fully verified accounts with advanced features. It not only enhances user convenience and accessibility but also empowers banks and financial institutions to explore new revenue streams, expand their reach, and deliver personalized services across diverse customer profiles.

CORE MODULES & FEATURE SET

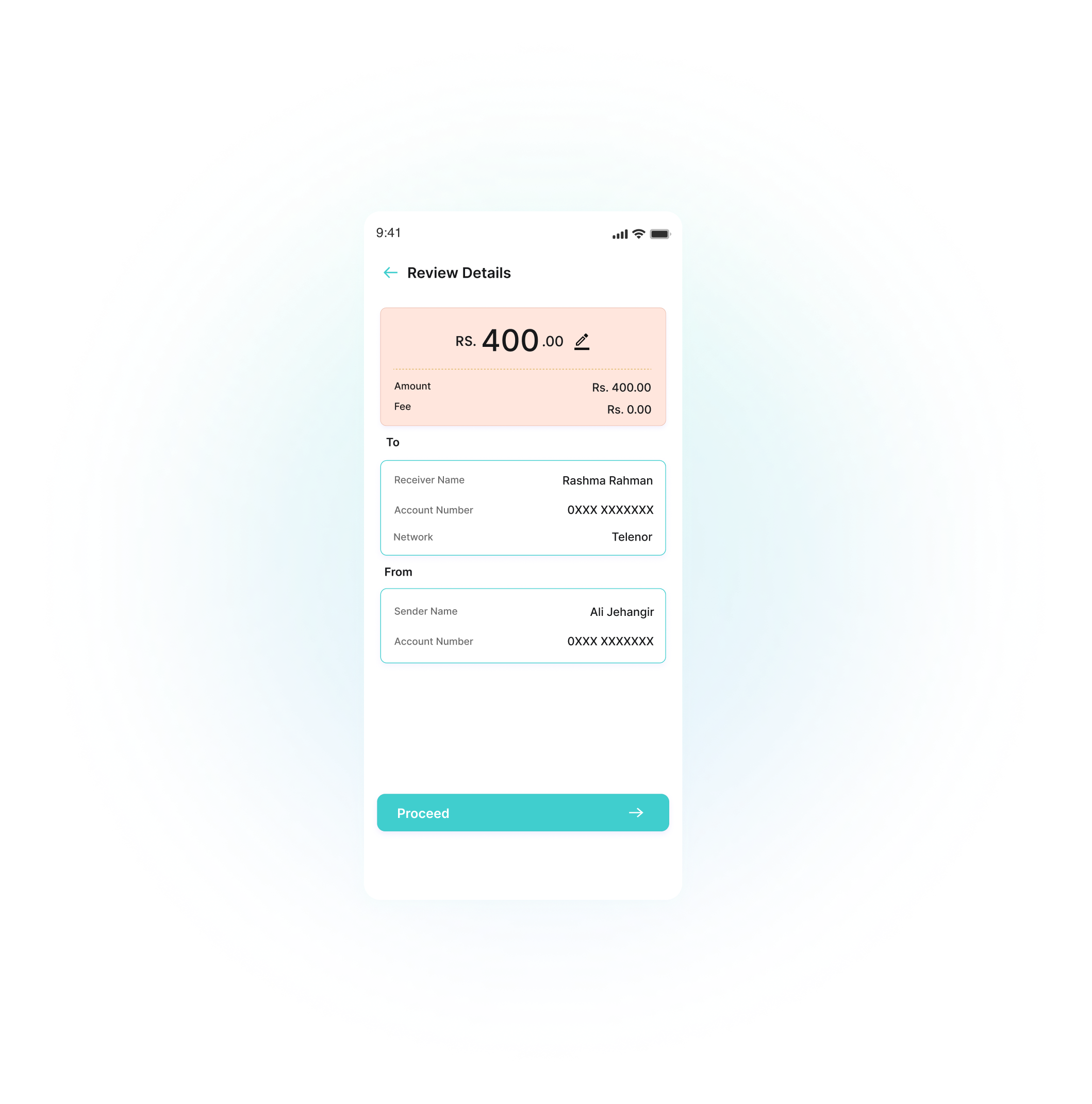

Transfers & Payments

Transfers & Payments

Our solution empowers users to move money securely and instantly across banks, wallets, and borders, supporting wallet-to-wallet transfers, IBFT and RAAST for local interbank payments via account or mobile number, international remittances through licensed partners, and convenient features like scheduled payments, payment requests, money gifting, bill splitting, and donations.

Service Payments & Bill Settlement

Service Payments & Bill Settlement

The platform supports an extensive list of billers and payment categories, making it easier than ever to manage everyday expenses. Users can conveniently handle mobile recharges, purchase bundles, and pay for utility bills, broadband services, and education fees. It also facilitates government-related payments such as taxes and licensing, ensuring compliance without hassle. Beyond that, the platform enables healthcare and insurance premium payments, supports corporate and real estate transactions, and even caters to additional needs like charity contributions, toll payments, and various top-up services — creating a truly comprehensive solution for all financial obligations.

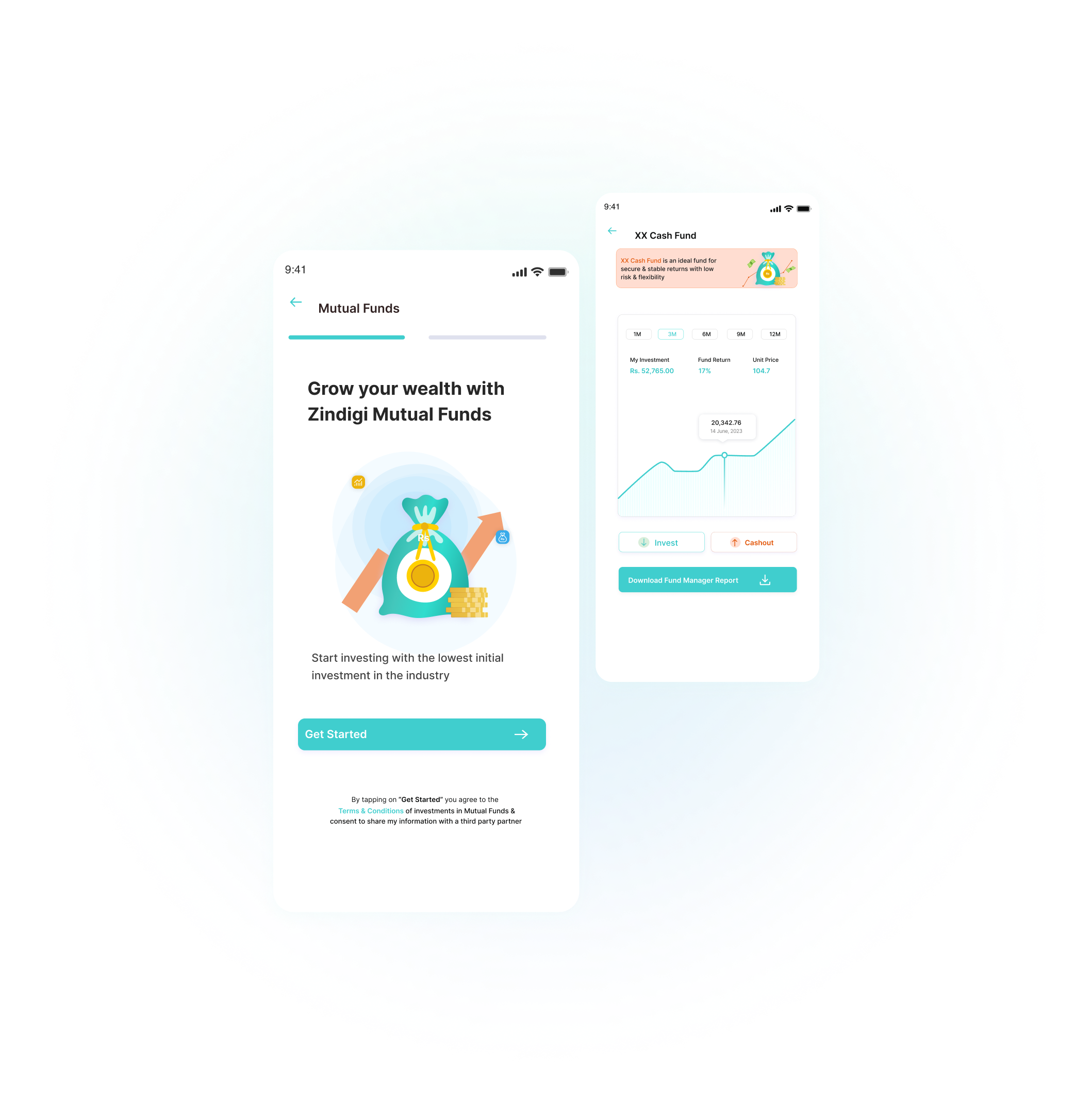

Savings & Investments

Savings & Investments

The platform empowers users to build long-term financial wellness through a range of investment and saving tools. It offers goal-based mutual fund investing integrated with licensed Asset Management Companies (AMCs), enabling users to plan and achieve their financial objectives efficiently. Additionally, the platform provides seamless access to stock trading via connected brokerage APIs, complete with real-time market data for informed decision-making. This combination of convenience and insight ensures that users can manage and grow their wealth with confidence and ease.

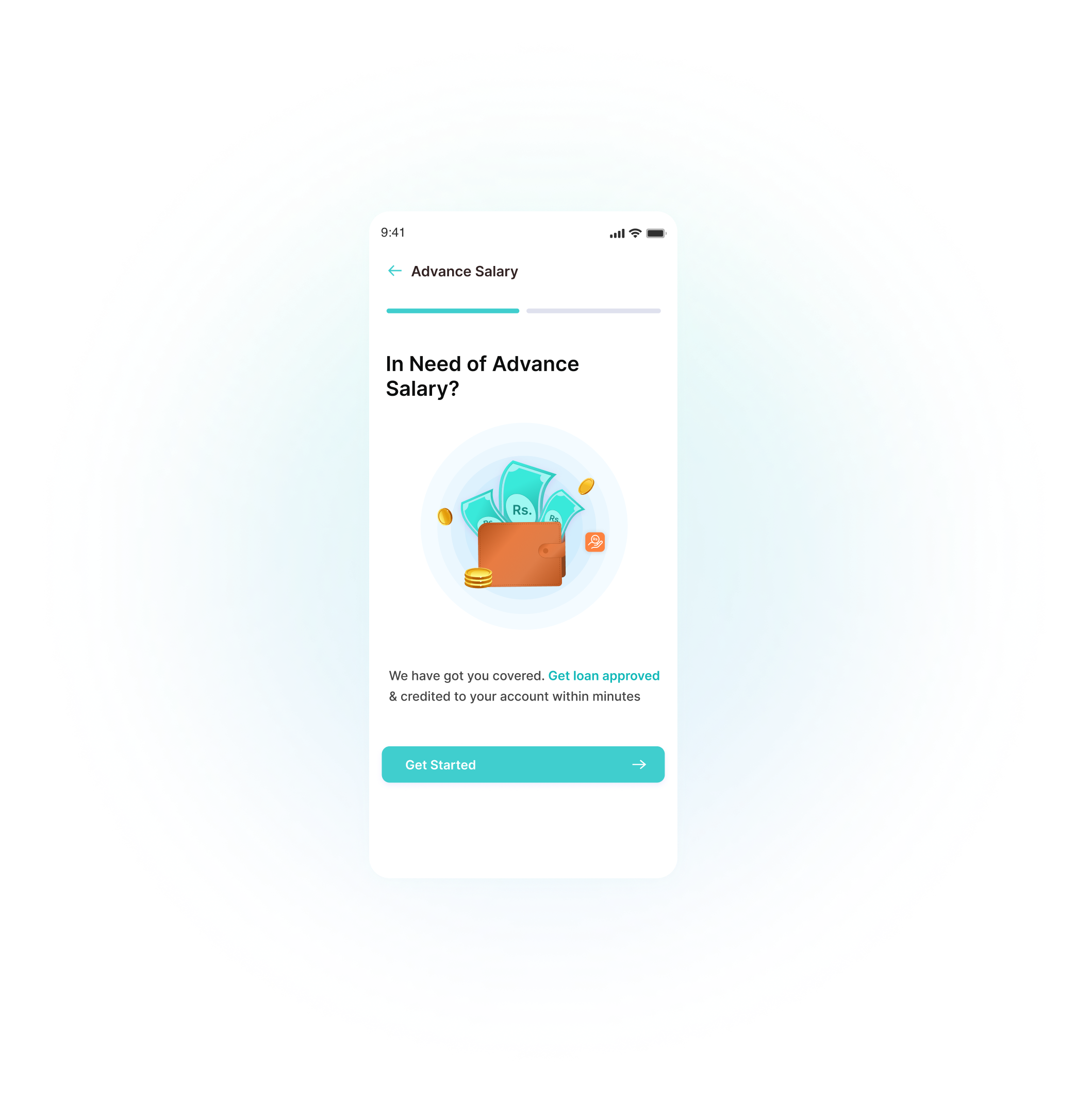

Credit & Lending Services

Credit & Lending Services

The platform provides flexible credit offerings specifically tailored to suit the financial needs of salaried professionals, freelancers, and daily wage earners. With products like Advance Salary, Advance Salary+, and Advance Cash, users can conveniently access funds when needed, ensuring financial stability and ease during critical times. These solutions are seamlessly integrated with employer payroll systems for quick disbursement and efficient management. Additionally, the platform offers the flexibility of early full repayment, empowering users with greater control over their financial commitments while promoting responsible borrowing practices.

WHAT MAKES THIS WALLET UNSTOPPABLE

Rewards & User Engagement

Incentivize retention with referral programs, daily draws like Spin & Win, and loyalty rewards.

Lifestyle & Entertainment

Extend wallet use with event tickets, Umrah and travel bookings, and digital vouchers for top platforms.

Insurance Services

Integrated micro-insurance for life, health, and travel with easy policy management and renewals.

Merchant Solutions

Empower merchants with QR payments, digital wallets, advanced analytics, and seamless paperless onboarding.

Account Management

Complete control with wallet balance, transaction history, cash flow insights, and account upgrades.

Fuel & Expense Management

Manage allowances, fleet expenses, and fuel budgets with prepaid cards and detailed reports.

Mini Apps & Open Ecosystem

Supports in-app marketplaces and third-party integrations.

- Z-Store for e-commerce

- Plankly integration for value-added services

- Convex: Access to exclusive games through a membership-based model

- Open APIs for fintech or non-financial partner app inclusion

TECHINAL OVERVIEW

To support mission-critical financial operations, the platform is built with enterprise-grade architecture:

- Cloud-native, microservices architecture with horizontal scalability — deployable on AWS, Azure, or private cloud

- End-to-end data encryption, biometric authentication (Face ID, Touch ID), and secure token-based session management

- Full regulatory compliance with KYC, AML, PSD2 equivalents, and data residency laws across jurisdictions

- Robust integration layer with real-time APIs for RAAST, IBFT, NADRA, telco billing systems, and third-party fintech providers

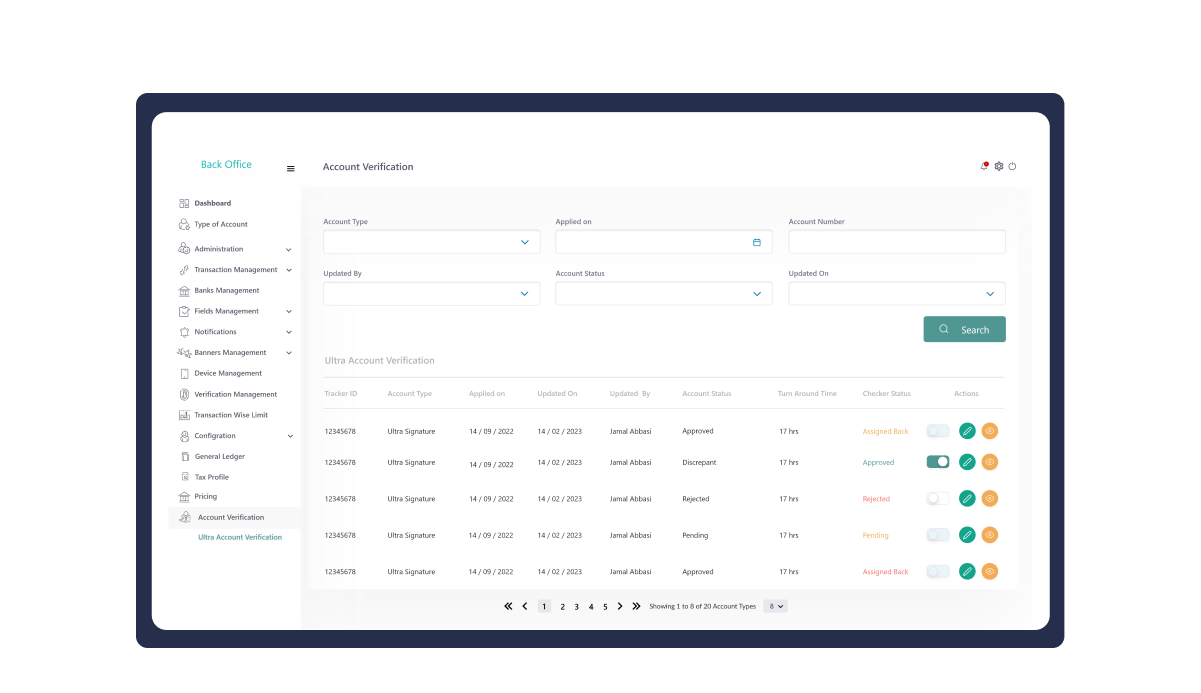

CENTRALIZED ADMIN PORTAL

The system offers real-time reporting and reconciliation, role-based controls with alerts, streamlined merchant onboarding and lifecycle management, and efficient transaction dispute resolution with escalation tracking.

Our client-driven roadmap unlocks future-ready features like AI-powered insights, automated budgeting, NFC and wearable payments, in-app government services, and advanced digital KYC — all customizable to your needs.